Tax compliance is very important for any business. Failing to properly collect and remit sales tax for your business can result in a number of issues, including back taxes, interest and fines. Online companies are not exempt from the proper collection of taxes, and with constantly changing tax codes and regulations, it is not only important that business owners know when to properly collect sales tax, but also how to configure their Magento store to do so.

There are obviously many different tax codes and regulations that can make proper collection very complicated. Fortunately, Magento has implemented a very flexible tax system that can be configured to function for most tax compliance requirements.

Magento uses the Mage_Tax module to provide helpers and tax calculator models to the rest of the system. This allows different tax rates for different customers based on customer group and location. A non-profit may qualify for a lower rate or a customer ordering from another location may have different taxes applied. Fortunately, with Magento, you are able set up special tax classes, rates, and rules to help collect the proper tax on purchases.

There are several important elements to configuring taxes in Magento: These are Tax Classes, Tax Zones and Tax Rates, and Tax Rules. To properly set up Tax Rules, you will need to set up your “Tax Classes” (for both Customers and Products) and your “Tax Zones and Tax Rates”.

Tax Classes Tax Classes are a type of grouping for setting up different tax rates for Products and Customers. Every product and customer is assigned to a tax class, it is a required attribute setting. Tax classes, in turn, are used to define tax rules. Tax rules are a combination of a Customer Tax Class, Product Tax Class, and Tax Rates.

Tax classes can be managed via the admin section Sales > Tax > Product Tax Classes (or Customer Tax Classes). When Creating new Tax Classes, you must provide a unique Tax Class name. By default, Magento includes options for product and customer tax classes (i.e. Taxable Good, Shipping and None). Once you save the new tax class it will be available for Products or Customers, depending on which was created.

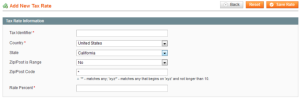

Tax Zones and Tax Rates Tax Rates are calculated as a percentage and are address-based (the Zones). Depending on the shop settings, it is possible to request a tax rate based on a customer address (shipping or billing) or on the address of the shop (default tax address or shipping origin address). When creating a tax rate you must specify to what location it applies by providing a country, a state or province (if applicable) and a Zip/Post code. You can see these inputs in the tax rate creation form that you can access by going to the “Manage Tax Zones and Rates” view (Sales > Tax > Manage Tax Zones & Rates) and clicking the Add New Tax Rate button:

Tax Rules Tax Rules are managed via Sales > Tax > Manage Tax Rules. From this section you will be able to set up a new Tax Rule, assign it a name, and select the Customer or Product Tax Class, select the Tax Rate, and assign a priority (if you have multiple Tax Rules).

Once you have configured these elements with the appropriate settings for your area, your store will automatically collect required taxes.

| Understand your Tax Obligations

US Taxes - Many states and local governments require you to charge taxes on sales at your physical location, as well as on telephone, online or mail-order sales to residents of states where your business has a "nexus" -- a physical presence, such as a retail storefront. Understand the rules for your state. Some states have no sales tax; some tax only merchandise; some tax merchandise and handling; and some tax merchandise, handling, and shipping. International Taxes - Unlike in the US, in Europe all product prices must be shown with the sales tax included (VAT, or TVA in France). Yet, it must be called out separately on the invoice. In all European countries (and Australia), product prices are required by law to be inclusive of taxes. Whether your business is located in the United States, Mexico, Canada, the United Kingdom, Germany, or Japan, it is important that you understand your tax obligations and any “nexus” that may exist from selling in other countries or states. |

As a MageTraining Partner, Avalara can help businesses navigate complicated tax compliance issues.